2025 Priorities for Business Leaders

Benefits Toolkit

Get the checklist, creative ideas to boost benefits, and proven techniques to build a happy and healthy workforce.

FORM HEADER Section

Limited Time Offer

Don't miss out on this unprecedented offer. Take advantage of this exclusive offer and outsource your payroll to Paychex.

The 2025 Tax Bill Just Changed the Game for Small Businesses

Your information is private and secure

Privacy Policy

Thanks for contacting us — we’re looking at your information to prepare the best possible solution for your business.

The next available rep will reach out at the number you provided.

Additional Resources

To help stay informed in the ever-changing HR landscape, view our:

Unlock Your Toolkit

Fill out the form below and the resources will all be available for download.

Free Text Section with H2 Header

Word count for this section: Maximum of 150-185 words, or 900-1,200 characters (with spaces). Adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque. Lorem ipsum dolor sit amet, sed do eiusmod tempor incididunt et dolore magna aliqua.

- Curabitur vitae nunc sed velit dignissim.

- Tincidunt eget nullam non nisi est sit.

- Tempor incididunt ut labore et dolore magna aliqua.

- Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel.

-

Risus quis varius quam quisque. Sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque Lorem ipsum dolor sit amet, consectetur.

New Tax Laws = New Opportunities (And New Risks)

The new tax laws create both opportunities and pitfalls for small businesses. Get the expert guidance to help you:

- Maximize deductions

- Claim new credits

- Stay compliant

Paychex is committed to helping small businesses thrive in the changing tax landscape. Fill out the form above to get immediate access to these helpful resources

Download Your Free FAQ Quick Reference Sheet

Complex tax questions, simple answers. Your go-to reference for navigating the new tax changes.

Enter to Win J.K. Lasser’s Small Business Taxes 2026

Enter to win Barbara Weltman's latest definitive tax guide—the resource businesses trust for year-round savings strategies.

Watch the Full Tax Bill Webinar Recording

The new tax bill is complex—but your strategy doesn't have to be.

Get the expert breakdown that turns confusing legislation into clear action steps.

Explore Our Services

Connect with one of our reps to explore what services might best fit the needs of your restaurant or quick-serve franchise.

Run Your Restaurant Without Running Ragged

Download our whitepaper chock full of helpful tips to guide you to success in this fast-paced industry.

Title

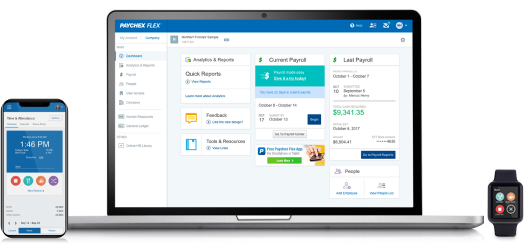

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Whitepaper Download Section

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Pro Tip

Watch to get expert insights and advice on employee benefits from a Paychex HR Business Professional.

Simple Columns Section

This section has 9 columns. Columns 3-9 can be turned off. This allows you to show anywhere from 2-9 columns.

For desktop we added a variable to control the space the column takes on the page - we can have 2 cols per row, or 3 cols per row, or 4 cols.

[is-one-half-desktop, is-one-third-desktop, is-one-quarter-desktop, is-one-fifth-desktop ]

.

Quisque non tellus orci ac auctor. Tortor consequat id porta nibh venenatis cras sed felis.

Imperdiet massa tincidunt nunc pulvinar. Nibh cras pulvinar mattis nunc sed.

Column Title1

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Title2

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Title3

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Title4

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Title5

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Title6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Title7

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Title8

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Title9

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

What's Trending?

According to Paychex's 2025 Prorities for Business Leaders study:

52%

Leaders who say their top priority is supporting employee well being.

$12,406

The average annual company cost to administer benefits.

39%

Leaders who say they'll evolve benefits to attract and keeop high-quality employees.

41%

Leaders who are increasing benefits as part of their benefits strategy.

Column Card Title 5

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Card Title 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Card Title 7

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Card Title 8

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Card Title 9

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Card Grid Section

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Card Title1

Run payroll quickly and easily, on desktop or mobile.

Card Title2

Run payroll quickly and easily, on desktop or mobile.

Card Title3

Run payroll quickly and easily, on desktop or mobile.

Card Title4

Run payroll quickly and easily, on desktop or mobile.

Card Title5

Run payroll quickly and easily, on desktop or mobile.

Card Title6

Run payroll quickly and easily, on desktop or mobile.

Card Title7

Run payroll quickly and easily, on desktop or mobile.

Card Title8

Run payroll quickly and easily, on desktop or mobile.

Card Title9

Run payroll quickly and easily, on desktop or mobile.

Card Title10

Run payroll quickly and easily, on desktop or mobile.

Card Title11

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Card Title13

Run payroll quickly and easily, on desktop or mobile.

Card Title14

Run payroll quickly and easily, on desktop or mobile.

Card Title15

Run payroll quickly and easily, on desktop or mobile.

Card Title16

Run payroll quickly and easily, on desktop or mobile.

Card Title17

Run payroll quickly and easily, on desktop or mobile.

Card Title18

Run payroll quickly and easily, on desktop or mobile.

Card Title19

Run payroll quickly and easily, on desktop or mobile.

Card Title20

Run payroll quickly and easily, on desktop or mobile.

Free Text

Open section to insert any component as needed.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent mi lacus, hendrerit sed commodo ut, dictum in ligula. Nam mollis nunc lectus, a finibus turpis lobortis sit amet. Nulla quis sollicitudin odio. Aenean suscipit dui nec ligula fringilla volutpat. Proin faucibus erat lorem, eu semper nunc viverra at. Integer hendrerit augue a fermentum venenatis. Suspendisse potenti. Sed vitae purus eu felis sagittis maximus. Mauris vel ex varius, aliquet urna in, fermentum leo.

- Item1

- Item2

- Item3

Compare a Paychex 401(k) vs. a state-run IRA

If you’re enrolled in the CalSavers IRA, switch to a plan with less administration and more tax savings. We make the transition easy with a dedicated 401(k) conversion account manager and a seamless onboarding process. See the comparison chart below to decide which plan is right for your business.

CalSavers IRA vs. Paychex 401(k) Plan

State — IRA

401(k) (Offered by Paychex)

Based on 2021 IRS Contribution Limits

$6,000

$19,500

No

Yes, at employer’s discretion

No

Opportunity for up to $5,000 per year, for the first 3 years

Employer processes payroll contributions, updates contribution rates, adds newly eligible, etc.

Paychex makes administration simpler as your recordkeeper

Split Section2 (image or video)

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

"Our Paychex HR professional, it's almost as if she's part of our operation. She knows a lot of the employees on a first name basis. She's part of the family."

Cathy Gill Controller and HR Director

Coronado Brewing Company

Split Section3 with header (image, video, or testimoninal)

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

H3 Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit.

Optional Button

Free Text

Open section to insert any component as needed.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent mi lacus, hendrerit sed commodo ut, dictum in ligula. Nam mollis nunc lectus, a finibus turpis lobortis sit amet. Nulla quis sollicitudin odio. Aenean suscipit dui nec ligula fringilla volutpat. Proin faucibus erat lorem, eu semper nunc viverra at. Integer hendrerit augue a fermentum venenatis. Suspendisse potenti. Sed vitae purus eu felis sagittis maximus. Mauris vel ex varius, aliquet urna in, fermentum leo.

Feeling Overwhelmed by 2025 Tax Changes?

Here are some additional resources to help with tax and employment compliance matters.

Split Section4 with header (image, video, or testimoninal)

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

H3 Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit.

- Item1

- Item1

- Item1

Optional Button

Split Section5 with header (image, video, or testimoninal)

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

H3 Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit.

Optional Button

Looking For More?

Tile Title 4

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Imperdiet dui accumsan sit amet nulla facilisi morbi tempus. Eget nullam non nisi est sit amet facilisis.

Tile Title 5

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Imperdiet dui accumsan sit amet nulla facilisi morbi tempus. Eget nullam non nisi est sit amet facilisis.

Tile Title 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Imperdiet dui accumsan sit amet nulla facilisi morbi tempus. Eget nullam non nisi est sit amet facilisis.

Tile Title 7

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Imperdiet dui accumsan sit amet nulla facilisi morbi tempus. Eget nullam non nisi est sit amet facilisis.

Tile Title 8

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Imperdiet dui accumsan sit amet nulla facilisi morbi tempus. Eget nullam non nisi est sit amet facilisis.

Tile Title 9

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Imperdiet dui accumsan sit amet nulla facilisi morbi tempus. Eget nullam non nisi est sit amet facilisis.

Looking For More?

Explore additional resources to expand your benefits strategy:

Act Now—These Changes Affect Your 2025 Taxes

The new laws are already impacting businesses like yours.

Access expert insights that show you how to comply, maximize savings, and turn complex regulations into competitive advantages.

CTA-Double Section

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent mi lacus, hendrerit sed commodo ut, dictum in ligula. Nam mollis nunc lectus, a finibus turpis lobortis sit amet. Nulla quis sollicitudin odio. Aenean suscipit dui nec ligula fringilla volutpat.

This can be a testimonial, plain text, an image, or video. You can make this a "card" (adds a border around the text) by adding the class "box" to the outer div.

Optional CTAThis can be a testimonial, plain text, an image, or video. You can make this a "card" (adds a border around the text) by adding the class "box" to the outer div.

Optional CTACTA Cards Title

lorem ipsum

Live and Recorded Webinars

View our webinars featuring many of today's leading experts in the payroll and HR industry.

Articles and Videos

Go in-depth with our dedicated articles and videos.

Free Bottom Text

Open section to insert any component as needed.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent mi lacus, hendrerit sed commodo ut, dictum in ligula. Nam mollis nunc lectus, a finibus turpis lobortis sit amet. Nulla quis sollicitudin odio. Aenean suscipit dui nec ligula fringilla volutpat. Proin faucibus erat lorem, eu semper nunc viverra at. Integer hendrerit augue a fermentum venenatis. Suspendisse potenti. Sed vitae purus eu felis sagittis maximus. Mauris vel ex varius, aliquet urna in, fermentum leo.