Pre-Hero Section

Added this section before our Form-Header Section to provide some introductory copy up high and have the form visible, but not the first thing that's seen.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Most business owners likely don’t have the time to effectively manage payroll, HR, benefits, and employment issues. This is time you could — and should — be spending on your business.

Paychex is proud to partner with your association. We can help members like you reduce the burden and risk of administering these tasks on your own.

Focus on Your Business and Leave Payroll and HR to Us.

Paychex is proud to partner with your business. We can help members like you reduce the burden and risk of administering payroll and HR tasks on your own.

Fill out the form below to learn more about how Paychex can help.

Your information is private and secure

Privacy Policy

Thanks for contacting us — we’re looking at your information to prepare the best possible solution for your business.

The next available rep will reach out at the number you provided.

Additional Resources

To help stay informed in the ever-changing HR landscape, view our:

Contact Us to Get Started

Fill out the form below and we'll be in touch shortly.

Free Text

Open section to insert any component as needed.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent mi lacus, hendrerit sed commodo ut, dictum in ligula. Nam mollis nunc lectus, a finibus turpis lobortis sit amet. Nulla quis sollicitudin odio. Aenean suscipit dui nec ligula fringilla volutpat. Proin faucibus erat lorem, eu semper nunc viverra at. Integer hendrerit augue a fermentum venenatis. Suspendisse potenti. Sed vitae purus eu felis sagittis maximus. Mauris vel ex varius, aliquet urna in, fermentum leo.

Blocks Section Header

We can have up to 12 cards here. Cards 1-3 are always showing. Cards 4-12 are hidden.

For desktop all cards are shown, while for mobile this will be a horizontal slider.

For desktop we added a variable to control the space the block takes on the page - we can have 2 cards per row, or 3 cards per row, or 4 cards. [is-one-half-desktop, is-one-third-desktop, is-one-quarter-desktop, is-one-fifth-desktop ]

Quisque non tellus orci ac auctor. Tortor consequat id porta nibh venenatis cras sed felis. Imperdiet massa tincidunt nunc pulvinar. Nibh cras pulvinar mattis nunc sed.

Why Restaurants Are Moving Away from Paying Card Tips in Cash

Paying employees credit or debit card tips in cash may create unnecessary challenges for employers. What strategies could improve your payroll efficiency?

Wine Bar Owner Finds Tax Refund Through Our ERTC Service

Run payroll quickly and easily, on desktop or mobile.The pandemic briefly halted her new business. But Courtney Benson was able to claim a refund, thanks to tax credits identified through our ERTC Service.

Regulations Your Restaurant Should Be Aware Of

Being in the restaurant or quick-serve franchise business means handling a number of payroll and HR responsibilities. Are you up-to-date on all of them?

Veteran Franchisee Finds Risks Are Worth the Rewards

Former Marine Tommy Stuckey invested his life savings to start his sub shop franchise, then grew to five stores. Hear his advice for fellow entrepreneurs.

Explore Our Services

Connect with one of our reps to explore what services might best fit the needs of your restaurant or quick-serve franchise.

Run Your Restaurant Without Running Ragged

Download our whitepaper chock full of helpful tips to guide you to success in this fast-paced industry.

Title

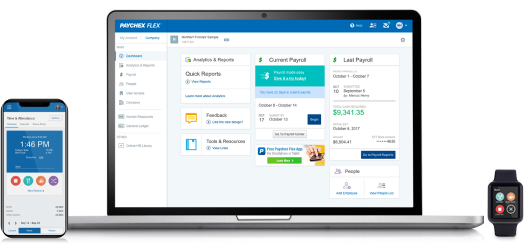

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Whitepaper Download Section

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Offering You the Benefit of a Single HR Solution

Paychex Flex®, our all-in-one HR, payroll, and benefits technology and service platform, can help you effectively manage your workforce today and as your needs change and grow, all from your desktop or mobile devices.

- Recruiting and applicant tracking

- Hiring and onboarding

- Time and attendance

- Payroll services

- HR and compliance services

- Health insurance management

- Retirement plan administration and recordkeeping

What You Can Expect

Add Value to Your Business

Since your association has a relationship with Paychex, you may be eligible for special pricing on our industry-leading HR solutions, adding even more value to your business.

Free Yourself to Focus on your Business

Our solutions are designed with business administrators — and their time — in mind. We can help you save time and resources so that you can focus on what’s important: your growth and success.

Column Title3

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Title4

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Title5

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Title6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Title7

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Title8

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Title9

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Cards Section

This section has 9 cards. Cards 3-9 can be turned off. This allows you to show anywhere from 2-9 columns.

These are like the simple columns, but have a box surrounding them.

For desktop we added a variable to control the space the card takes on the page - we can have 2 cards per row, or 3 cards per row, or 4 cards.

[is-one-half-desktop, is-one-third-desktop, is-one-quarter-desktop, is-one-fifth-desktop ]

Quisque non tellus orci ac auctor. Tortor consequat id porta nibh venenatis cras sed felis.

Imperdiet massa tincidunt nunc pulvinar. Nibh cras pulvinar mattis nunc sed.

Column Card Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Card Title 2

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Card Title 3

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Card Title 4

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Card Title 5

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Card Title 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Card Title 7

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Card Title 8

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Column Card Title 9

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Card Grid Section

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Card Title1

Run payroll quickly and easily, on desktop or mobile.

Card Title2

Run payroll quickly and easily, on desktop or mobile.

Card Title3

Run payroll quickly and easily, on desktop or mobile.

Card Title4

Run payroll quickly and easily, on desktop or mobile.

Card Title5

Run payroll quickly and easily, on desktop or mobile.

Card Title6

Run payroll quickly and easily, on desktop or mobile.

Card Title7

Run payroll quickly and easily, on desktop or mobile.

Card Title8

Run payroll quickly and easily, on desktop or mobile.

Card Title9

Run payroll quickly and easily, on desktop or mobile.

Card Title10

Run payroll quickly and easily, on desktop or mobile.

Card Title11

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Card Title13

Run payroll quickly and easily, on desktop or mobile.

Card Title14

Run payroll quickly and easily, on desktop or mobile.

Card Title15

Run payroll quickly and easily, on desktop or mobile.

Card Title16

Run payroll quickly and easily, on desktop or mobile.

Card Title17

Run payroll quickly and easily, on desktop or mobile.

Card Title18

Run payroll quickly and easily, on desktop or mobile.

Card Title19

Run payroll quickly and easily, on desktop or mobile.

Card Title20

Run payroll quickly and easily, on desktop or mobile.

Free Text

Open section to insert any component as needed.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent mi lacus, hendrerit sed commodo ut, dictum in ligula. Nam mollis nunc lectus, a finibus turpis lobortis sit amet. Nulla quis sollicitudin odio. Aenean suscipit dui nec ligula fringilla volutpat. Proin faucibus erat lorem, eu semper nunc viverra at. Integer hendrerit augue a fermentum venenatis. Suspendisse potenti. Sed vitae purus eu felis sagittis maximus. Mauris vel ex varius, aliquet urna in, fermentum leo.

- Item1

- Item2

- Item3

Compare a Paychex 401(k) vs. a state-run IRA

If you’re enrolled in the CalSavers IRA, switch to a plan with less administration and more tax savings. We make the transition easy with a dedicated 401(k) conversion account manager and a seamless onboarding process. See the comparison chart below to decide which plan is right for your business.

CalSavers IRA vs. Paychex 401(k) Plan

State — IRA

401(k) (Offered by Paychex)

Based on 2021 IRS Contribution Limits

$6,000

$19,500

No

Yes, at employer’s discretion

No

Opportunity for up to $5,000 per year, for the first 3 years

Employer processes payroll contributions, updates contribution rates, adds newly eligible, etc.

Paychex makes administration simpler as your recordkeeper

"We have quite a few employees that are working remote these days and Paychex Flex® really allows them to go in at any time and really check on their payroll, check on their contributions, and really look and make sure that everything is accurate."

— Terri Cubiotti, COO

Split Section2 (image or video)

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

"Our Paychex HR professional, it's almost as if she's part of our operation. She knows a lot of the employees on a first name basis. She's part of the family."

Cathy Gill Controller and HR Director

Coronado Brewing Company

Split Section3 with header (image, video, or testimoninal)

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

H3 Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit.

Optional Button

Free Text

Open section to insert any component as needed.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent mi lacus, hendrerit sed commodo ut, dictum in ligula. Nam mollis nunc lectus, a finibus turpis lobortis sit amet. Nulla quis sollicitudin odio. Aenean suscipit dui nec ligula fringilla volutpat. Proin faucibus erat lorem, eu semper nunc viverra at. Integer hendrerit augue a fermentum venenatis. Suspendisse potenti. Sed vitae purus eu felis sagittis maximus. Mauris vel ex varius, aliquet urna in, fermentum leo.

RSS Feed Module

Use 1 for payroll, 11 for HR, 21 for Employee Benefits, 31 for Startup, 41 for Compliance, 1051 is YE, and 'all' is the latest from all categories. Test in the previewer: https://pages.paychex.com/RSS-Previewer.html

Split Section4 with header (image, video, or testimoninal)

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

H3 Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit.

- Item1

- Item1

- Item1

Optional Button

Paychex Flex® Software Integrations and Business Solutions

Our APIs Connect Popular HR, Productivity, and Financial Tools.

Visit the Paychex Marketplace to shop our expanding API library and start sharing data between Paychex Flex and your other favorite HR tools. You can also access our network of trusted service providers who are evolving the future of work.

Extend the Value You Bring to Your Business

Remove the burden of vetting payroll and HR providers

Partner with Paychex — a proven and trusted industry leader with more than 50 years of experience and more than 730,000 clients nationwide — and save time and effort required to compare payroll and HR companies.

Get access to tools to attract top talent

Finding and retaining employees with the right skill sets is tough, but a powerful hiring and applicant-tracking solution can help. Paychex can help you find top candidates and offer Fortune 500-caliber benefits.

Maintain compliance with a legislative and regulatory resource

With our team of highly trained HR professionals, Paychex can help you in your efforts to adhere to complex federal, state, and local laws and regulations.

Tile Title 4

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Imperdiet dui accumsan sit amet nulla facilisi morbi tempus. Eget nullam non nisi est sit amet facilisis.

Tile Title 5

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Imperdiet dui accumsan sit amet nulla facilisi morbi tempus. Eget nullam non nisi est sit amet facilisis.

Tile Title 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Imperdiet dui accumsan sit amet nulla facilisi morbi tempus. Eget nullam non nisi est sit amet facilisis.

Tile Title 7

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Imperdiet dui accumsan sit amet nulla facilisi morbi tempus. Eget nullam non nisi est sit amet facilisis.

Tile Title 8

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Imperdiet dui accumsan sit amet nulla facilisi morbi tempus. Eget nullam non nisi est sit amet facilisis.

Tile Title 9

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Imperdiet dui accumsan sit amet nulla facilisi morbi tempus. Eget nullam non nisi est sit amet facilisis.

Hear From Some of Our Customers

If you are looking to outsource, Paychex can help you manage HR, payroll, benefits, and more.

Optional Button-

EDIT CLIENT's QUOTE HERE

CLIENT's NAME

COMPANY NAME

-

EDIT CLIENT's QUOTE HERE

CLIENT's 2 NAME

COMPANY2 NAME

-

EDIT CLIENT's QUOTE HERE

CLIENT's 3 NAME

COMPANY3 NAME

-

EDIT CLIENT's QUOTE HERE

CLIENT's 4 NAME

COMPANY4 NAME

More than 730,000 businesses trust Paychex.

CTA-Double Section

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent mi lacus, hendrerit sed commodo ut, dictum in ligula. Nam mollis nunc lectus, a finibus turpis lobortis sit amet. Nulla quis sollicitudin odio. Aenean suscipit dui nec ligula fringilla volutpat.

This can be a testimonial, plain text, an image, or video. You can make this a "card" (adds a border around the text) by adding the class "box" to the outer div.

Optional CTAThis can be a testimonial, plain text, an image, or video. You can make this a "card" (adds a border around the text) by adding the class "box" to the outer div.

Optional CTAResources for your Business

Our webinars, articles, and videos contain best practices to help you handle business challenges.

Live and Recorded Webinars

View our webinars featuring many of today's leading experts in the payroll and HR industry.

Articles and Videos

Go in-depth with our dedicated articles and videos.