This is a Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Are You Eligible for Thousands of Dollars in ERTC funds? Answer a Few Questions to Find Out.

Take our assessment to see if you may be eligible for the ERTC. Submit this form and we'll contact you shortly.

Basic Information

Your Information

Your information is private and secure

Privacy Policy

Limited Time Offer

Three Months Free Payroll

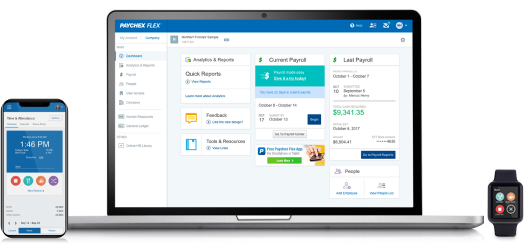

Paychex makes it easy to pay and manage employees

Free Text

Open section to insert any component as needed.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent mi lacus, hendrerit sed commodo ut, dictum in ligula. Nam mollis nunc lectus, a finibus turpis lobortis sit amet. Nulla quis sollicitudin odio. Aenean suscipit dui nec ligula fringilla volutpat. Proin faucibus erat lorem, eu semper nunc viverra at. Integer hendrerit augue a fermentum venenatis. Suspendisse potenti. Sed vitae purus eu felis sagittis maximus. Mauris vel ex varius, aliquet urna in, fermentum leo.

Blocks Section Header

We can have up to 12 cards here. Cards 1-3 are always showing. Cards 4-12 are hidden.

Quisque non tellus orci ac auctor. Tortor consequat id porta nibh venenatis cras sed felis. Imperdiet massa tincidunt nunc pulvinar. Nibh cras pulvinar mattis nunc sed.

Why Restaurants Are Moving Away from Paying Card Tips in Cash

Paying employees credit or debit card tips in cash may create unnecessary challenges for employers. What strategies could improve your payroll efficiency?

Wine Bar Owner Finds Tax Refund Through Our ERTC Service

Run payroll quickly and easily, on desktop or mobile.The pandemic briefly halted her new business. But Courtney Benson was able to claim a refund, thanks to tax credits identified through our ERTC Service.

Regulations Your Restaurant Should Be Aware Of

Being in the restaurant or quick-serve franchise business means handling a number of payroll and HR responsibilities. Are you up-to-date on all of them?

Veteran Franchisee Finds Risks Are Worth the Rewards

Former Marine Tommy Stuckey invested his life savings to start his sub shop franchise, then grew to five stores. Hear his advice for fellow entrepreneurs.

Explore Our Services

Connect with one of our reps to explore what services might best fit the needs of your restaurant or quick-serve franchise.

Run Your Restaurant Without Running Ragged

Download our whitepaper chock full of helpful tips to guide you to success in this fast-paced industry.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

This is a Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Find Out if You Qualify for the ERTC

Take our quick assessment to see if you pre-qualify for the Employee Retention Tax Credit (ERTC). We’ve been successful in helping more than 49,000 businesses receive an average of $190,0001 in tax credits. Will you be one of them?

Yes, I want to know if I qualify for the ERTC.

This is a Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

This is a Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

This is a Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

This is a Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

This is a Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

These are Column Cards

Columns 3-5 can be turned off. This allows you to show anywhere from 2-5 columns. These are like the simple columns, but have a box surrounding them. Quisque non tellus orci ac auctor. Tortor consequat id porta nibh venenatis cras sed felis. Imperdiet massa tincidunt nunc pulvinar. Nibh cras pulvinar mattis nunc sed.

This is a Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

This is a Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

This is a Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

This is a Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

This is a Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

This is the Card Grid

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

Title

Run payroll quickly and easily, on desktop or mobile.

What is the ERTC?

Because you kept your employees working during the COVID-19 pandemic, you may be eligible to get back some of the money you paid in payroll taxes.

- The ERTC is a refundable credit you can claim on qualified wages you paid employees — upwards of 70%

- You have three years to claim the credit retroactively from when you filed your original tax return

- The Paychex ERTC Service helps businesses claim the Employee Retention Tax Credit retroactively to March 12, 2020

Our Team Has Helped More Than 49,000 Businesses Receive ERTC Funds. Here’s How.

Our ERTC experts have helped thousands of eligible businesses across the country receive tax credits that are as much as 70% of wages paid. That can add up to more than $100,000 in some cases. If you’re business is eligible, our specially trained ERTC experts will:

- Do a complete review of wages to determine if they qualify

- Provide a report and documentation of all calculations

- Prepare and file your amended return accurately so that it doesn’t get delayed or rejected

Think of what you could do with that kind of money—promote your business, reward your employees, or just save it for a rainy day. If you’re eligible, our ERTC Service Team will help make it happen.

Compare a Paychex 401(k) vs. a state-run IRA

If you’re enrolled in the CalSavers IRA, switch to a plan with less administration and more tax savings. We make the transition easy with a dedicated 401(k) conversion account manager and a seamless onboarding process. See the comparison chart below to decide which plan is right for your business.

CalSavers IRA vs. Paychex 401(k) Plan

State — IRA

401(k) (Offered by Paychex)

Based on 2021 IRS Contribution Limits

$6,000

$19,500

No

Yes, at employer’s discretion

No

Opportunity for up to $5,000 per year, for the first 3 years

Employer processes payroll contributions, updates contribution rates, adds newly eligible, etc.

Paychex makes administration simpler as your recordkeeper

This is a Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

I had one specific source to go to and they answered all my questions and led me in the right direction.

Dan Banaitis Owner and Program Director

Building Bridges Program

How This Wine Bar Got a $60,000 Fresh Start

Talk about bad timing. Courtney Benson opened Viticulture Wine Bar just days before the government ordered businesses to shut down due to COVID-19. Although closing her business was a challenge, Courtney’s determination kept it afloat and she was eventually able to rehire employees. Her Paychex representative suggested she consider the Employee Retention Tax Credit (ERTC). To her surprise, she was eligible for 50% of payroll refunds for 2020, and 70% for 2021, and expects to get nearly $60,0001 refunded to her. Courtney plans to use the funds to promote her business and reward her staff with pay raises.

Watch our video to see how this business got its groove back.

This is a Title

lorem ipsum

This is a Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

This is a Title

lorem ipsum

This is a Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

- Item1

- Item1

- Item1

This is a Title

lorem ipsum

This is a Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Curabitur vitae nunc sed velit dignissim. Tincidunt eget nullam non nisi est sit. Faucibus purus in massa tempor nec feugiat. Vitae tortor condimentum lacinia quis vel. Risus quis varius quam quisque.

Nobody is excited about changing payroll companies...

Kevin Hull Chief Financial Officer

TYR Tactical

Reasons to Switch to Paychex

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Non pulvinar neque laoreet suspendisse interdum consectetur libero id faucibus. Vel pharetra vel turpis nunc.

Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Imperdiet dui accumsan sit amet nulla facilisi morbi tempus. Eget nullam non nisi est sit amet facilisis.

Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Imperdiet dui accumsan sit amet nulla facilisi morbi tempus. Eget nullam non nisi est sit amet facilisis.

Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Imperdiet dui accumsan sit amet nulla facilisi morbi tempus. Eget nullam non nisi est sit amet facilisis.

Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Imperdiet dui accumsan sit amet nulla facilisi morbi tempus. Eget nullam non nisi est sit amet facilisis.

Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Imperdiet dui accumsan sit amet nulla facilisi morbi tempus. Eget nullam non nisi est sit amet facilisis.

Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Imperdiet dui accumsan sit amet nulla facilisi morbi tempus. Eget nullam non nisi est sit amet facilisis.

Get Help Finding Tax Credits

Even if you weren’t a customer in 2020 and 2021, switch providers to Paychex and we can help you with an initial review to see if you’re eligible for the Employee Retention Tax Credit3.